Table of Contents

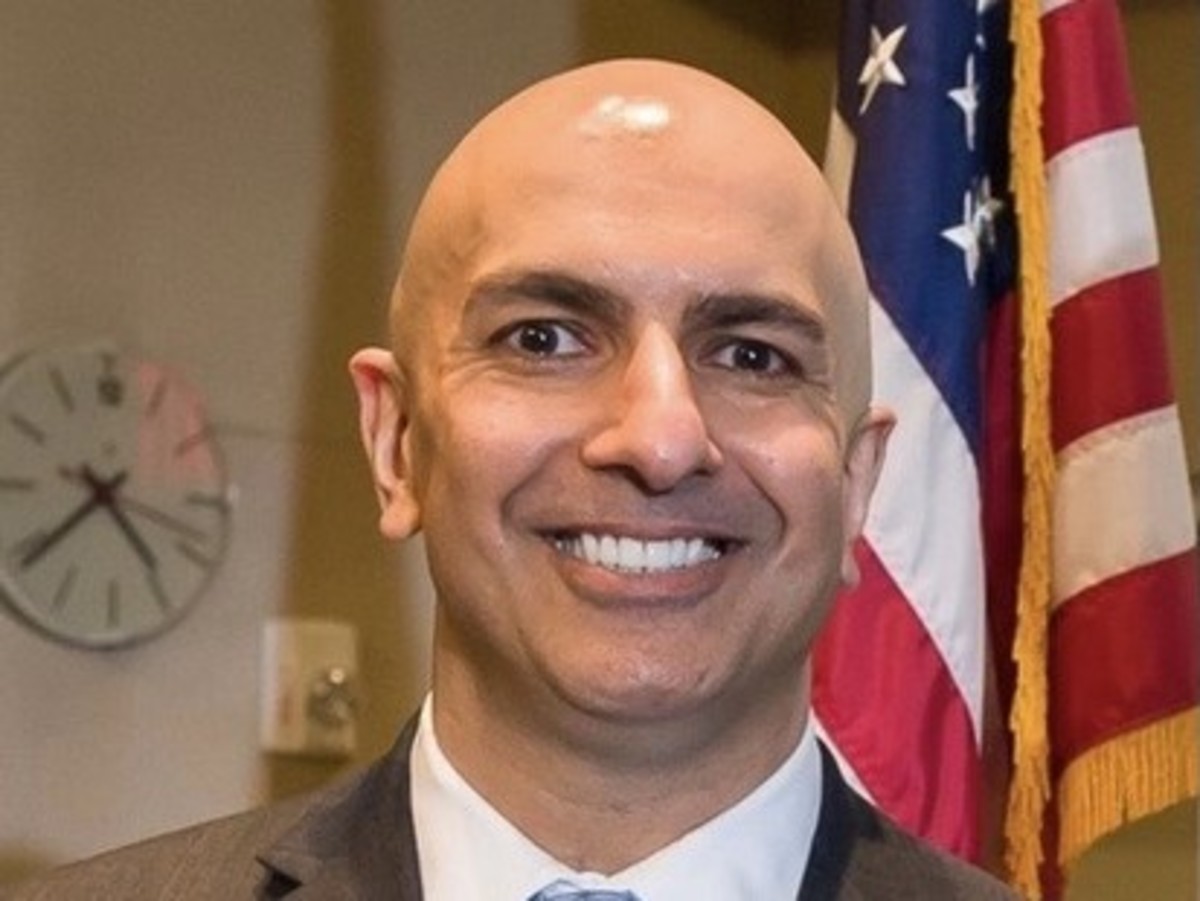

- Fed’s Neel Kashkari: Break Up the Big Banks - WSJ

- Neel Kashkari Measures Inflation By How Much It Costs To Sustain A ...

- 他领导了金融救助,但表示银行仍然太大而不能倒闭:NPR | Notion

- Neel Kashkari - YouTube

- Neel Kashkari - Alchetron, The Free Social Encyclopedia

- Neel Kashkari: My vote against Fed rate hike is based on lack of inflation

- Fed's Kashkari: 50 bps rate cut was the right decision | Forexlive

- 他领导了金融救助,但表示银行仍然太大而不能倒闭:NPR | Notion

- Federal Reserve Bank of Minneapolis Neel Kashkari hints at holding off ...

- Fed May Delay Rate Cuts Until After 2024, Neel Kashkari Says - Bloomberg

Kashkari's Stance on Fed Intervention

The Need to Squash Inflation

Implications of Fed Intervention

By understanding the implications of Fed intervention, investors and policymakers can make informed decisions that promote economic stability and growth. The Fed's role in shaping the economy is crucial, and its actions will continue to be closely watched in the years to come.

Some of the key takeaways from Kashkari's views on Fed intervention include:

- The Fed should intervene only reluctantly and with caution.

- The Fed still needs to squash inflation to maintain price stability.

- The Fed's actions can have unintended consequences, such as creating asset bubbles or distorting market prices.

- The Fed's primary goal is to promote maximum employment and price stability.

As the economy continues to navigate the complexities of the post-pandemic world, the Fed's role will be crucial in shaping the economic landscape. By understanding the implications of Fed intervention, we can better navigate the challenges and opportunities that lie ahead.